Everyone wants to know if they are doing well financially in the grand scheme of things. In our capitalist society, wealth is something most people aspire to. But how wealthy is wealthy and how do we know if we are on the right track? A website called globalrichlist.com has created a great interface in which you can enter your income or net wealth and compare it to that of the rest of the world. Its unclear where they get their data from and I doubt it is 100% accurate, however, it is still pretty interesting and worth having a look at.

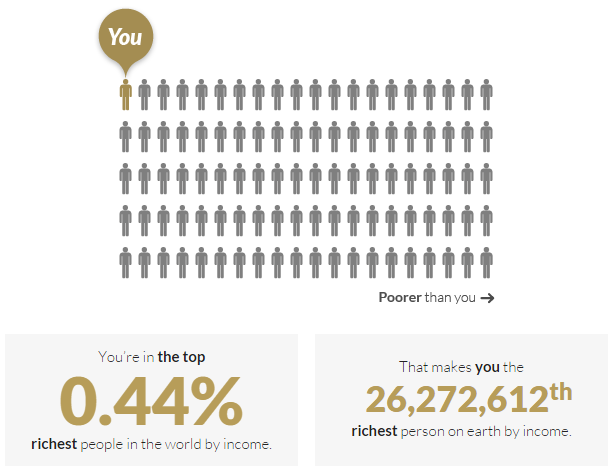

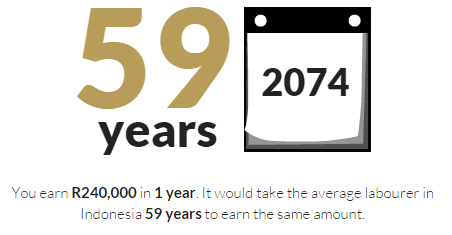

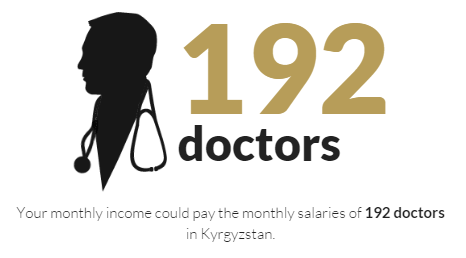

I did a test run and used a simple net annual income of R240,000 per annum (thats a net of R20,000 per month). According to the website, that would put you in the top 0.44% richest people in the world, or at number 26,272,612 of the entire global population. That really puts things into perspective and has the potential to make any complaints you might have about not earning enough completely moot. If the simple statistics of where you fit globally aren’t enough, if you keep scrolling down, they make the comparison even clearer and more startling. See the results below:

I think the moral of the story is to be grateful for what you have. What little you may have could mean a whole lot to someone else on the planet. Go ahead and plug your net income in here to see where you stand.