At some stage in life everyone aspires to have a home of their own, but circumstances such as not earning enough income to qualify for a bond can often come in the way. Fortunately, banks do allow individuals to apply for home loans jointly to be able to realise their dreams.

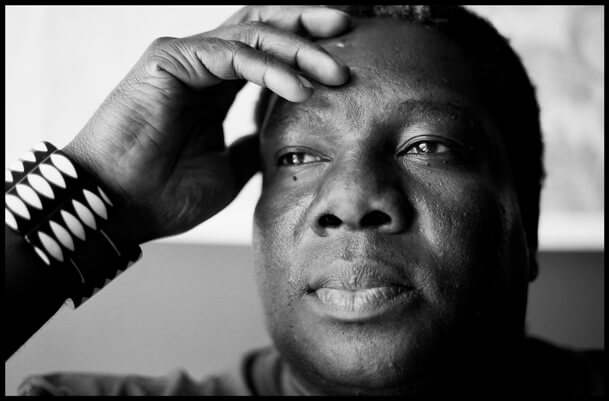

Dr Simphiwe Madikizela, Head of Special Projects at FNB Housing Finance says a joint application can help increase your chances of qualifying as both parties’ incomes and expenses are taken into account to assess the affordability based on their disposable income.

“Before applying for a joint bond, you should be aware of the advantages and disadvantages to avoid any pitfalls,” says Madikizela.

Pros:

There is a high likelihood that the housing loan application will be approved if both individuals have a good credit record.

You can afford to buy property that one partner wouldn’t necessarily afford with their salary alone.

You could benefit from a good interest rate as affordability assessment is done on both parties.

You are only liable for half of the bond payments and legal fees.

Cons:

If you are not married, you will share ownership of the property with another individual once paid off.

If there is a default, both partners’ credit records are affected.

Should one partner want to pull out of the bond agreement, a new bond application will have to be processed and a full credit assessment conducted on the application to verify affordability.

In addition, the home loan facility will be closed, which means you will have to pay bond registration fees for the new home loan facility.

Upon the approval of the home loan, the bank may require both applicants to have adequate life cover that will be ceded onto the bond.

During the application process, both parties need to sign all the necessary documents such as the offer to purchase, home loan quote and legal documents, etc.

Most importantly, the monthly debit order has to come from one account. As a result, this will have to be agreed beforehand to ensure that there are always funds available to avoid defaulting on the monthly bond repayments.

“Buying a property is a big commitment and the decision to buy with someone else should not be taken lightly. The parties need to work out all the eventualities before taking ownership as shortcomings could potentially set you back financially,” concludes Madikizela.