An article (see it here) that did the rounds on social media in October 2014 created massive debate and a mild sense of panic amongst twenty-something’s and young parents by exposing the extravagant fees demanded by South Africa’s most expensive private schools. Hilton College topped the list with annual fees of R 209,000. That excludes other essentials such as uniforms, text books, stationery, sports equipment and the odd local or overseas tour. No matter which way you look at it, that is a massive sum of money! If you have the statistical 2.2 kids, you are in the hole for nearly half a million rand before you have put a loaf of bread on the table.

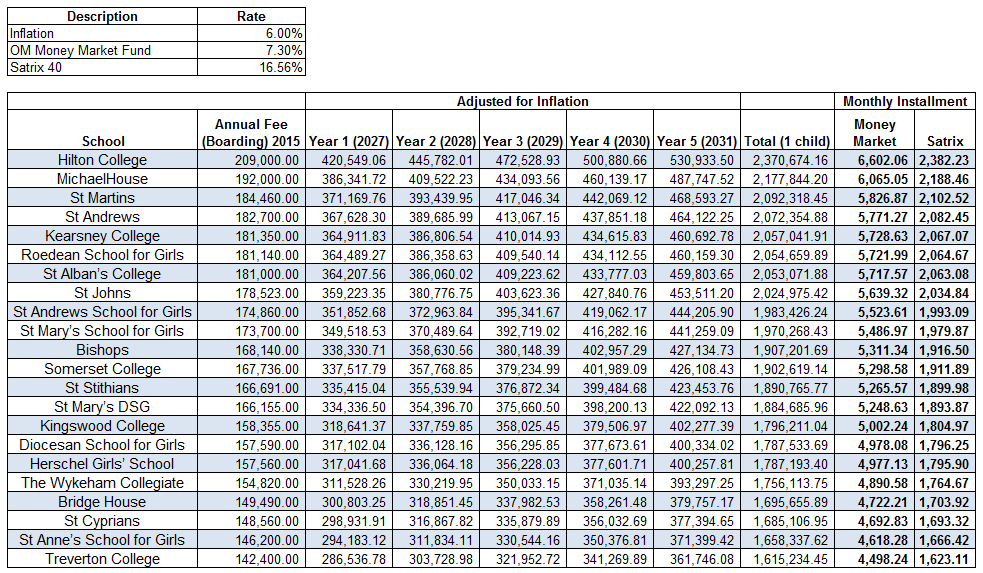

With these figures in mind, I thought it would be interesting to see how much you would need to put away per month in order to save enough to send just 1 child to the most expensive schools in the country. At an inflation rate of 6%, if you had a son today, you would need to come up with R420,549.06 by the year 2027 for his first year of high school at Hilton College, by the time he reaches matric, you will be paying R530,933.50 for the year.

Unless you are really fortunate, stumble upon the next big tech start up or you win the lotto, that kind of money will demand that you start investing today! If we use an average annual inflation rate of 6% to calculate the future value of the annual school fees and we compare two types of investment, a money market fund (lower risk) and an exchange traded fund over the top 40 JSE equities (higher risk) we come up with some pretty interesting (and perhaps scary) results when calculating the required monthly installment if you were to start today. I used the Old Mutual Money Market Fund in this example, the fund has returned an average 7.30% per annum over the last 10 years. For the ETF, I used Satrix 40 purely because that is probably the one that most people might be aware of. The Satrix 40 ETF has returned an average of 16.56% per annum since its inception in December 2000.

The ETF appears to be the immediate best option based on the average annual return, however, it comes at a higher risk, while the money market fund should consistently produce a positive return (baring credit default scenarios, eg ABIL), equity tracker funds can very easily have a negative return (as most did in 2008). It all comes down to your risk appetite and your risk / reward profile. If you wanted to send your son to Hilton College in 2027, you would need to put away R6,602.06 per month in the Old Mutual Money Market Fund or R2,382.23 into the Satrix 40 ETF every month starting today! While this may be a little bit skewed as your earning potential should in theory increase year on year and the installment will stay the same, it is still a pretty good representation of the cost of a decent education these days! Click on the table below to see what you would need to invest every month in order to afford each of the top 22 most expensive schools in the country.