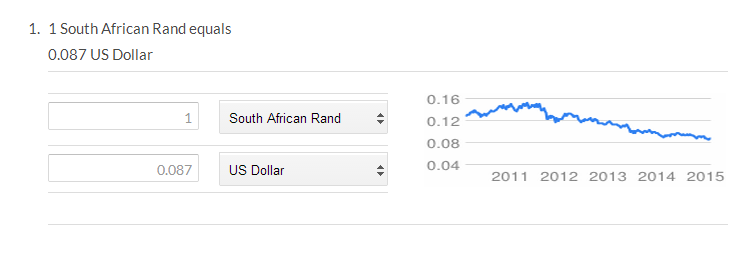

Let me start on a very deep wave this month, and say thanks to all the guys in the National Financial planning, you guys definitely are doing a very crappy job. I checked the rands to the dollar today and I was shocked at the way the economy is doing ” we doing so bad”.

I walked into one of the grocery stores by my place in centurion and noticed a price change for almost all the basic commodities. So I can tell am not the only feeling the January, we all are, the difference is, some of us cope well than others. The insane truth is that, while some of us owe no one and isn’t interested in owing anyone, some people are deepening in debt, year in, year out.

I recently read about the spiritual approach to money on Kris Carr’s Crazy Sexy Life. The first thing it emphasized was facing your fears about money by looking at your situation square in the face. This got me thinking about the many ways millenials get themselves into these situations to begin with. How do we impede ourselves from reaching financial success in our 20s?

1. Credit Card Debt

This is the real kicker, isn’t it? How many of you have spent your way into oblivion? Given the statistics concerning credit card debt in South Africa probably quite a few of you. In fact the average working class owes about 20k to 40k in debt. Furthermore, the average credit card debt for 25 to 34 year olds has increased 40% between 1989 and 2004 .

Seriously guys, what the hell are we doing to ourselves here? Using a credit card is one of the most expensive ways to borrow money. Sure, if you use them responsibly they can be a great asset, but clearly we’re doing something wrong here.

2. Not having a budget.

No one likes the word budget. The word itself seems tedious, boring, and even really scary for some. Unfortunately, there’s really no way around having to create one so you’re just going to have to tackle the monster head on – unless of course you’d just rather live in ignorance about your finances.

Trust me, you’ll feel better once you have a budget in place because you’ll actually SEE where your money is coming from and where it’s going. If you need some help creating a budget make sure to subscribe to the mailing list and get your free budget template (among other things).

3. Not contributing to a UIF or IP.

If your employer is matching any part of your UIF contribution you’d better sign up ASAP, otherwise you’re just giving up free money. If your employer doesn’t offer a UIF I’d suggest opening up an IP (Investment Portfolio). All you need is below R1000 a month and you’ll be well on your way to saving for retirement. OldMutual Retirement and ALLANGRAYretirement are good places to start. When you calculate your investment period and investment capital , it would give you an idea of how much time you have left to make the best of this opportunities.

4. Using debt to pay off another debt.

This is possibly one of the stupidest things I’ve heard people do with their money (besides burning it). For the love of all things good and holy do not use a credit card to pay off another card. Or your student loan to pay off your car loan. Or a personal loan to pay off a business loan. It doesn’t solve anything – you still owe the money “dur”!

5. Not even bothering to invest.

With the way the markets have been behaving the past few years I can’t totally blame this generation for being scared of investing. What I can blame you for is not doing your research anyway.

The South African is proven to be pretty damn resilient and you’re young enough to ride out the craziness we’re experiencing. Besides, it’s easier than ever to invest wisely. Don’t take my word for it though, check out Ramit Sethi’s (I WIll Teach You To Be Rich) explanation on lifecycle funds, also known as target date funds.

6. Not developing a side hustle.

I may be a bit biased here because I make extra money as a blogger , journalist and online investor, but it’s with good reason that I’m constantly telling you guys to start your own businesses. It’s liberating, puts you in the driver’s seat, and it’s good to know that you have a way of making extra money in case your day job doesn’t pan out. If you need some help deciding what kind of a business you should start check out these side businesses you can start on your own.

7. Not knowing the difference between what you need and what you want.

I still suffer with this all the time. We grew up in an age of consumerism so we like shiny things. A new iPad is coming out? Let’s buy it for way more money than it’s actually worth. There’s a new Android phone? Let me buy a new one NOW instead of waiting until I get my upgrade.

We really need to stop doing this. The next time you feel an urge to buy something expensive and shiny step back, take a few breaths, and come back to grips with reality – you don’t actually need it.

(Although I do love my Mac ![]() I just won’t buy one every time they upgrade it. )

I just won’t buy one every time they upgrade it. )

8. Buying a brand new car.

Why on earth would you buy something brand new that will undoubtedly depreciate in value over time? Better yet why would you take out a loan for something that will depreciate in value?

A car is not property, which always has the possibility of bouncing back. It’s not a student loan which in theory is supposed to get you a better paying job.

It is not an investment – or well, it’s a horrible investment. In case you didn’t know, your wheels lose value as soon as you drive them off the lot. Save up your money to buy a car, or do what I do – Or buy a used car , take the bus (Seriously, public transit saves you a ton of money and forces you to exercise. Win!).

9. Sticking to a big bank.

Another good thing to come of out of the stolen wallet fiasco is that I finally switched banks. Instead I switched to a bank which is a low cost operator – meaning no crazy ass fees for stupid crap. They also have high yield savings accounts that provide much better bang for your buck.

10. Not having an emergency fund. (Or any savings, period.)

An emergency fund is paramount! It’s how you can handle those surprise necessary expenses like visiting the doctor or the car breaking down. It’s also good to have in case you get laid off so you can at least live off of something while you find a job (you’ll wish you’d started a side business by then).

If you think you can’t save take a look around and you’ll notice you spend a lot money on unnecessary things. You don’t need a R24.00 coffee everyday. You don’t need to eat out so much. You don’t need to buy that many drinks at the bar. Those three alone could save you a nice chunk of cash.

Conclusion:

All of the aforementioned obstacles have solutions so you can conquer them. Granted, it may not be easy but you have to stare your financial situation square in the face. The earlier you cultivate healthy financial habits the longer they’ll stick and the faster you’ll see relief.